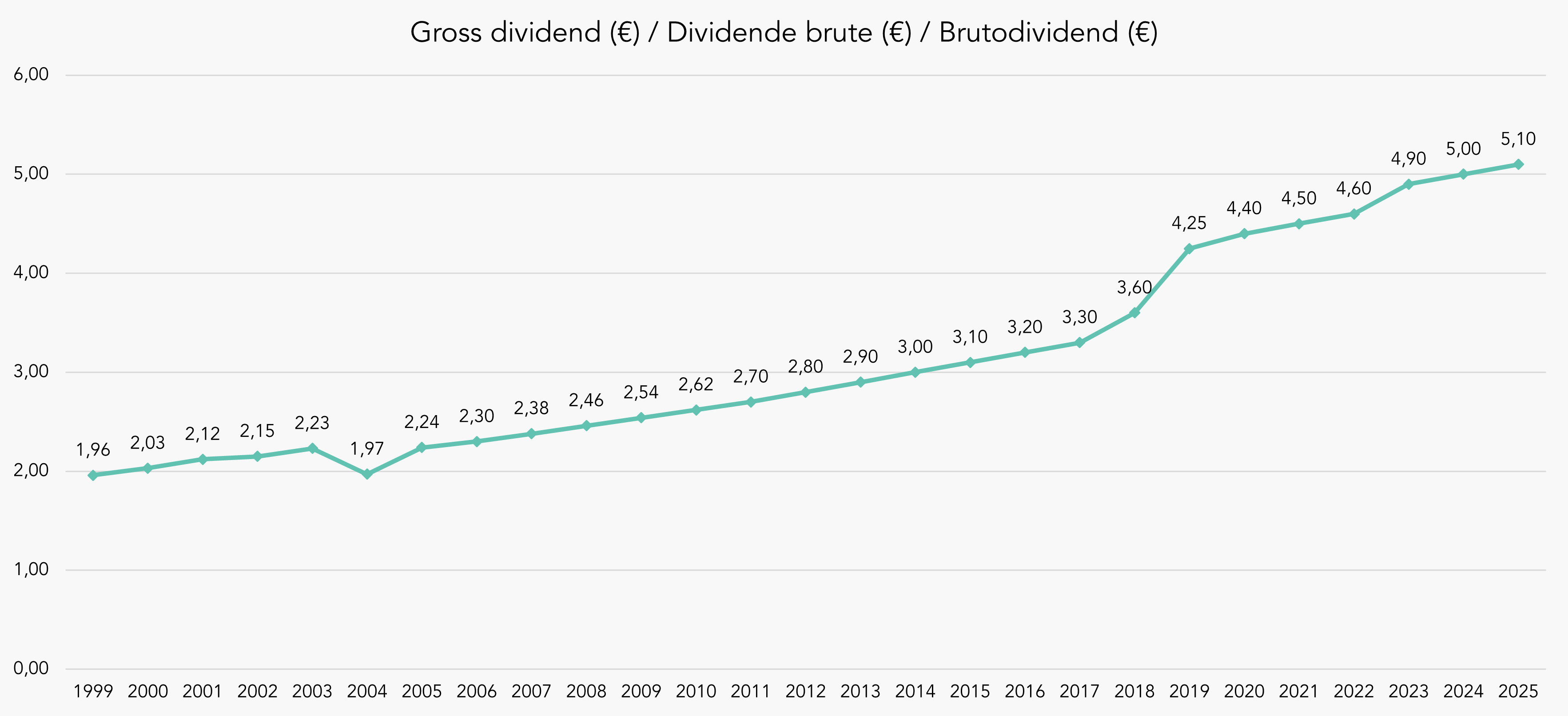

Dividend evolution

Dividend distribution policy

A GVV/SIR (Belgian REIT) is obliged to maintain minimum 80% of current earnings to pay out a dividend. The dividends for payment made by a Belgian company are subject to a withholding tax of 30% which is deducted at source. The dividend payment is done by presenting the coupon at the counters of KBC Bank.

| Coupon | Gross dividend | Net dividend | Payment | Details |

|---|---|---|---|---|

| 1 | 0.00 (*) | 0.00 | 27/04/1999 | Capital increase |

| 2 | 1.96 | 1.66 | 14/06/1999 | Dividend exercise 1998/1999 |

| 3 | 2.03 | 1.75 | 14/06/2000 | Dividend exercise 1999/2000 |

| 4 | 2.12 | 1.80 | 02/07/2001 | Dividend exercise 2000/2001 |

| 5 | 2.15 | 1.83 | 02/07/2002 | Dividend exercise 2001/2002 |

| 6 | 0.00 (*) | 0.00 | 01/07/2003 | Capital increase |

| 7 | 2.23 | 1.90 | 27/06/2003 | Dividend exercise 2002/2003 |

| 8 | 1.00 | 0.85 | 07/01/2004 | Interimdividend |

| 9 | 0.97 | 0.82 | 02/07/2004 | Dividend exercise 2003/2004 |

| 10 | 2.24 | 1.90 | 05/07/2005 | Dividend exercise 2004/2005 |

| 11 | 2.30 | 1.95 | 04/07/2006 | Dividend exercise 2005/2006 |

| 12 | 2.38 | 2.02 | 03/07/2007 | Dividend exercise 2006/2007 |

| 13 | 2.46 | 2.09 | 01/07/2008 | Dividend exercise 2007/2008 |

| 14 | 2.54 | 2.16 | 07/07/2009 | Dividend exercise 2008/2009 |

| 15 | 2.62 | 2.23 | 06/07/2010 | Dividend exercise 2009/2010 |

| 16 | 2.70 | 2.295 | 05/07/2011 | Dividend exercise 2010/2011 |

| 17 | 2.80 (**) | 2.212 | 27/07/2012 | Dividend exercise 2011/2012 |

| 18 | 0.00 (*) | 0.00 | Capital increase | |

| 19 | 2.90 | 2.175 | 12/07/2013 | Dividend exercise 2012/2013 |

| 20 | 3.00 | 2.25 | 11/07/2014 | Dividend exercise 2013/2014 |

| 21 | 3.10 | 2.325 | 10/07/2015 | Dividend exercise 2014/2015 |

| 22 | 0.00 (*) | 0.00 | Capital increase | |

| 23 | 3.20 | 2.336 | 08/07/2016 | Dividend exercise 2015/2016 |

| 24 | 3.30 | 2.310 | 01/08/2017 | Dividend exercise 2016/2017 |

| 25 | 0.00 (*) | 0.00 | Capital increase | |

| 26 | 3.60 | 2.52 | 31/07/2018 | Dividend exercise 2017/2018 |

| 27 | 4.25 (**) | 2.975 | 24/06/2019 | Interim dividend 2018/2019 |

| 28 | 4.40 | 3.08 | 20/08/2020 | Dividend exercise 2019/2020 |

| 29 | 4.50 | 3.15 | 26/07/2021 | Dividend exercise 2020/2021 |

| 30 | 4.60 | 3.22 | 25/07/2022 | Dividend exercise 2021/2022 |

| 31 | 4.90 | 3.43 | 12/07/2023 | Interim optional dividend 2022/2023 |

| 32 | 5.00 | 3.50 | 27/06/2024 | Interim optional dividend 2023/2024 |

| 33 | 5.10 | 3.57 | 26/06/2025 | Interim optional dividend 2024/2025 |

(*) Coupon reserved for the exercise of the right following the capital increase. Unexercised rights were traded on Euronext scripts (auction).

(**) Stock optional dividend.